Ashcroft Capital Lawsuit: Investor Allegations and $18M in Damages Explained

The Ashcroft Capital lawsuit has drawn attention in the real estate and investment world, raising questions about investor protection and fund transparency. Founded by Joe Fairless and Frank Roessler, Ashcroft Capital is known for managing large multifamily real estate portfolios across the United States. The lawsuit, however, has prompted debates about how private real estate investment firms handle investor funds, communications, and returns.

While legal disputes in the investment sector are not uncommon, the Ashcroft Capital lawsuit highlights key concerns about financial accountability, investor relations, and the risks tied to syndication-based real estate investments. This article explores the lawsuit in depth, the claims involved, and its implications for investors and the multifamily property industry.

Background of Ashcroft Capital

Ashcroft Capital is a U.S.-based real estate investment firm specializing in multifamily properties. The company has managed over $2 billion in assets and operates under a value-add strategy—acquiring underperforming apartment communities and improving them for higher returns.

The company gained popularity through its syndication model, where investors can pool funds to acquire large apartment complexes. However, as the Ashcroft Capital lawsuit came into focus, questions arose about management practices, disclosures, and performance representations.

| Key Facts About Ashcroft Capital | Details |

|---|---|

| Founded By | Joe Fairless and Frank Roessler |

| Focus Area | Multifamily Real Estate |

| Assets Under Management | Over $2 Billion |

| Investment Model | Syndication and Value-Add Properties |

| Headquarters | New York, USA |

| Lawsuit Involves | Investor Claims, Transparency, and Financial Disputes |

What Triggered the Ashcroft Capital Lawsuit

The Ashcroft Capital lawsuit reportedly centers around allegations of misrepresentation, lack of transparency, and potential mishandling of investor funds. Some investors have claimed that the company failed to fully disclose risks associated with specific property investments or did not deliver returns as projected.

While full legal details remain confidential in certain cases, lawsuits like this often arise from perceived misalignment between investor expectations and actual outcomes. In real estate syndications, investors rely heavily on sponsor integrity, communication, and financial disclosures. When performance deviates from projections or when communication breaks down, legal challenges can surface.

Investor Concerns and Allegations

Investors involved in the Ashcroft Capital lawsuit have raised several key issues. These include claims of misleading information during investment pitches, delayed updates about property performance, and concerns about fund allocation.

Here’s a summary of the major investor concerns:

| Investor Concern | Description |

|---|---|

| Misleading Projections | Some investors allege that projected returns were unrealistic or based on incomplete data. |

| Poor Communication | Delays in financial reporting and lack of transparency in project updates. |

| Fund Mismanagement | Questions raised about how capital contributions were utilized or distributed. |

| Exit Strategy Issues | Disagreements regarding property sale timing or profit distribution. |

These allegations are still subject to legal review and have not been proven in court. Ashcroft Capital, on its part, maintains that it operates within legal and ethical standards and that market fluctuations often influence investment outcomes.

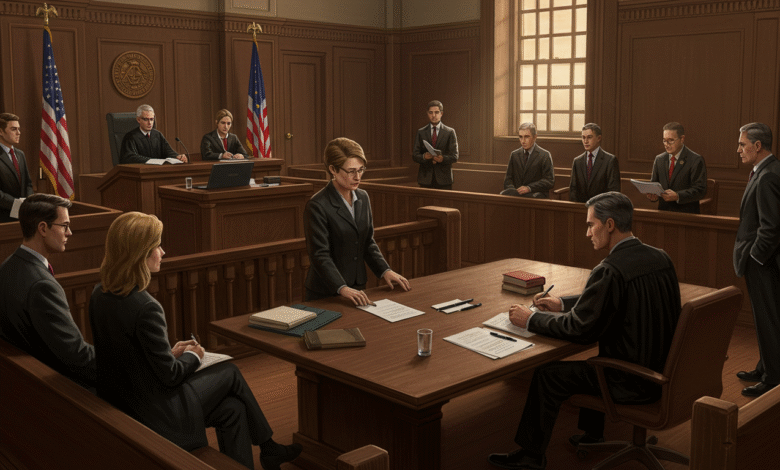

Legal Developments in the Ashcroft Capital Lawsuit

As of the latest reports, the Ashcroft Capital lawsuit remains under investigation, with multiple parties reviewing claims and corporate documentation. The legal proceedings will likely focus on whether the company breached fiduciary duties, violated securities laws, or misrepresented financial data.

In many such cases, plaintiffs seek compensation for financial losses or improved disclosure policies for future investors. The court’s findings could also set a precedent for how syndication-based real estate investments are marketed and regulated.

Impact on Investors and the Multifamily Real Estate Market

The Ashcroft Capital lawsuit has caused ripples across the multifamily investment community. It serves as a reminder of the importance of due diligence before investing in syndications or private placements.

Investors are now paying closer attention to:

-

The experience and transparency of fund managers.

-

The accuracy of financial projections.

-

The structure of profit-sharing agreements.

-

The level of regulatory oversight in real estate funds.

If the lawsuit leads to stricter disclosure requirements, it could positively influence investor protection and trust in the long term. However, it also highlights how market volatility, operational risks, and communication gaps can create friction between sponsors and investors.

Comparing Ashcroft Capital with Other Real Estate Syndication Firms

To understand the potential implications of the Ashcroft Capital lawsuit, it helps to compare the firm’s structure and approach with other real estate syndication companies.

| Aspect | Ashcroft Capital | Typical Syndication Firm |

|---|---|---|

| Investment Type | Multifamily Properties | Mixed Assets (Residential, Commercial) |

| Management Style | Active Value-Add Strategy | Passive or Semi-Active |

| Investor Access | Accredited Investors Only | Often the Same |

| Transparency | Subject of Recent Lawsuit | Varies by Firm |

| Return Structure | Based on Performance Fees | Performance & Equity Based |

| Legal Challenges | Active Investigation | Case-Dependent |

This comparison shows that while syndication remains a strong investment method, it heavily depends on transparency and ethical fund management.

Lessons from the Ashcroft Capital Lawsuit

The Ashcroft Capital lawsuit underscores several important lessons for both investors and investment sponsors:

-

Due Diligence Matters – Investors should always review company documents, market data, and financial statements before committing funds.

-

Communication Builds Trust – Regular updates and transparent reporting prevent misunderstandings and potential legal action.

-

Understand Risk vs. Reward – Real estate investments carry risks, including market downturns and operational setbacks.

-

Legal Safeguards Are Essential – Investors should ensure contracts clearly outline responsibilities, exit strategies, and dispute resolution processes.

These lessons apply not only to Ashcroft Capital but to any private real estate investment platform.

Public and Industry Reactions

The Ashcroft Capital lawsuit has sparked discussions among real estate professionals and investors about accountability and industry standards. Some believe the case highlights the growing pains of an evolving private investment sector, while others see it as a call for greater oversight and investor education.

Industry forums and investor networks have also used this case as an example to stress the importance of third-party audits and independent financial reviews in real estate syndications.

The Future of Ashcroft Capital After the Lawsuit

Despite the ongoing Ashcroft Capital lawsuit, the company continues to manage its existing portfolio and pursue new investment opportunities. How the firm addresses investor concerns and rebuilds confidence will determine its long-term reputation.

Potential outcomes include:

-

Settlements or Restructuring: The company may reach a legal settlement with investors or adjust its reporting practices.

-

Enhanced Transparency: More frequent updates, audits, and financial disclosures to reassure investors.

-

Regulatory Changes: The lawsuit could influence how private real estate funds are governed in the future.

Conclusion

The Ashcroft Capital lawsuit serves as a cautionary example in the real estate investment landscape. It underscores the critical role of transparency, accurate reporting, and investor relations in maintaining trust and compliance.

For investors, the case highlights the importance of performing thorough due diligence before joining syndication deals. For sponsors, it’s a reminder that reputation and honesty are as valuable as any property portfolio.

As the legal process unfolds, the results of the Ashcroft Capital lawsuit will likely shape how multifamily investment firms communicate with their investors and manage funds for years to come.